Landmark federal infrastructure legislation is reducing costs for American households and businesses and drawing more private investment interest into the U.S. market, according to new reports from industry experts.

However, increasingly severe weather events, unpredictable travel patterns, an uptick in energy demand, and shifts in carbon emission policies pose challenges to covering the full scope of infrastructure investment needs long-term.

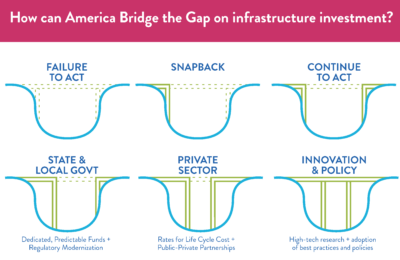

‘Bridging the Gap’, a once-every-four-year economic report from the American Society of Civil Engineers (ASCE), finds that each American household saves $700 per year when current federal infrastructure spending – established by the $550 billion in new funding from the Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA) – become the baseline for funding. Under the “Continuing to Act” scenario, each U.S. household loses $2,000 per year due to faulty infrastructure; in the “Snapback” to pre-IIJA funding levels scenario, those losses amount to $2,700 yearly.

In addition to the benefits for families, infrastructure investment pays dividends to businesses. By 2033, the country’s exports will save $1 trillion, and U.S. GDP will improve by more than $630 billion when these investment levels are maintained, rather than “snapping back” to pre-IIJA funding levels when the law expires in 2026.

The ASCE report analyzes the costs to households, businesses, and U.S. GDP when infrastructure isn’t working properly – potholes leading to car repairs, poorly designed transportation systems causing bottlenecks, water main breaks shutting down businesses and forcing residents to buy bottled water, power outages interrupting manufacturing processes. Each interruption to our economy due to insufficient infrastructure has cascading effects, which ultimately are paid for by U.S. consumers, reducing their buying power and stalling economic growth.

Decades of inaction and underinvestment caused the gap in America’s federal infrastructure spending to grow at an accelerated pace, allowing systems to age without proper maintenance or expansion. As a result, the investment gap, comparing needs to planned expenditures, grew to $2.9 trillion over ten years.

The ASCE report shows that the IIJA and IRA helped to stop the bleeding, as the new investment gap prediction remains at $2.9 trillion if these investment levels continue. However, reverting to pre-IIJA levels would cause the gap to increase to $3.7 trillion by 2033. This underinvestment in federal infrastructure spending has an outsized impact on the manufacturing industry, which would lose more than $280 billion in production costs by 2033 if current funding levels “snap back” in 2026.

How Private Investments Can Support Federal Infrastructure Spending & Help Close Funding Gaps

While the new federal investments have played a significant role in stopping the growth of the infrastructure gap, it takes action and buy-in from state and local governments along with private investment to help close it.

Luckily, more predictable funding from the federal government is drawing major interest from private investors. Data from the Global Infrastructure Investor Association’s (GIIA) latest Pulse Survey of its members shows that the U.S. is the number one most attractive investment destination for investors worldwide, representing a surge of new interest since the passage of bipartisan infrastructure bills.

Like any investor looking to be part of a business, they need dependable partners to help reduce risk and ensure they get a fair return on their investment. For this to happen, there needs to be legislative consistency and funding certainties so investors know where would be most prudent or beneficial. The GIIA report highlights the importance of the following:

- Streamlining cumbersome permitting processes

- Developing schemes to enable more public-private partnerships (P3s)

- Setting more consistent guidelines across all 50 states and the commonwealths

If these obstacles can be overcome, it also clears the pathway for many tens of thousands of new construction jobs.

Another hold-up for private investment: clarity on what is needed. Not all infrastructure projects are conducive to private investment without a clear path to yielding returns, but the sector could fill in gaps where the situation is right. Public investment opportunities are, in many cases, not communicated clearly or consistently to the private sector.

GIIA advocates for establishing P3 offices in all 50 states to increase collaboration between the sectors and reduce the overall investment gap of $2.9 trillion over 10 years, as estimated by ASCE, which was never meant to be a bill footed exclusively by the federal government. GIIA notes successes in places like Virginia, where P3 projects have been run smoothly, and to the benefit of local communities across the state.

GIIA advocates for establishing P3 offices in all 50 states to increase collaboration between the sectors and reduce the overall investment gap of $2.9 trillion over 10 years, as estimated by ASCE, which was never meant to be a bill footed exclusively by the federal government. GIIA notes successes in places like Virginia, where P3 projects have been run smoothly, and to the benefit of local communities across the state.

Societal needs are constantly evolving. Innovations such as electric vehicles, Artificial Intelligence (AI), the emergence of larger post-Panamax vessels, and policies such as moving our electric grid to be carbon neutral and developing new trade agreements between countries are just a few examples of how the world’s needs will continuously shift, and the built environment will always be forced to adapt. This means that fully closing the infrastructure investment gap is not a realistic expectation.

However, we can do better than a $2.9 trillion gap that costs U.S. households – even with continued investment – $2,000 per year. Effective collaboration between the federal government and state and local governments, in addition to collaborating with the private sector, are key to ensuring a safer and more efficient America.

Marsia Geldert-Murphey, President of the American Society of Civil Engineers, and Jon Phillips, CEO of the Global Infrastructure Investor Association