Oregon once again finds itself at the forefront of gas tax increases. The state was the first to levy a gas tax, in 1919. Ever since it has been innovative in its funding of transportation, including through the OreGo vehicle miles traveled pilot program. This year’s legislative activity continues the trend.

Bringing its 2017 Legislative Session to a close it sent a 10-cent per gall graduated gas tax increase to Governor Kate Brown for signature. When the 4-cent per gallon initial increment takes effect in 2018, it will be the first gas tax increase the state has seen in about five years when the rate was last adjusted for inflation. The gas tax will also increase gradually to 10-cents per gallon through 2024. As many states wait 20 years to adjust for inflation, Oregon is a leader by revisiting the issue more frequently.

HB 2017 has the potential to raise an estimated $1 billion per fiscal year for state highways when at full effect during the 2025-27 biennium. Being a leader in the area of transportation funding one unique feature of the transportation is the implementation of a $15 fee on bicycle purchases that exceed $200. For a state that is heavy on cycling, this addition truly ensures that everyone is contributing to road maintenance.

In addition to the gas tax increase and bike fee, revenue is set to be generated through these additional revenue streams:

- An $16 flat increase in vehicle registration fees plus an additional tiered-fee will be assessed based on vehicle mileage to ensure everyone pays for their share of the roads.

- Implements a 0.1% payroll tax to fund transit systems.

- Implements a 0.5% new car sales tax to be allocated to multimodal programs.

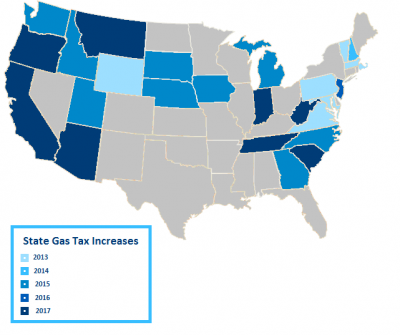

Once Governor Brown pens her signature the bill makes Oregon the sixth state in 2017 and the 24 state since 2013 to raise its gas tax. A special thank you to the ASCE Oregon Section for their efforts in reaching out to legislators to encourage the passage of this bill.