In the past few weeks, states across the country have experienced an onslaught of power outages due to more severe storms and rising heat temperatures–from Iowa to Texas. And then there’s California, a state that’s faced extreme weather, spurring fire tornadoes, lightning storms, record heat. In August, the Golden State has also recently instituted rolling blackouts as the demand for electricity increases, and to keep the electricity grid from completely melting down. Why is this happening, and how can we prevent more brownouts, blackouts, and other interruptions–especially as most of us are working from home, essentially turning our own homes into data centers?

The United States electric grid is undergoing significant changes and to accommodate this shift, significant investments in the grid are needed, according to a new report ASCE released today. The report, “Electric Infrastructure Investment Gaps in a Rapidly Changing Environment,” finds that the United States is underinvesting in the electricity grid, which is projected to cause each household to lose on average $5,800 between 2020 and 2039. The West, with its major land expanse and large population in California, accounts for 33% of the total national gap, while the Northeast and Mid-Atlantic regions – with some of the oldest infrastructure in the U.S. – account for 43% of the gap.

ASCE unveiled the report through a virtual press conference, sponsored by Siemens. Panelists included experts in the sector, including Tom Smith, Executive Director of the American Society of Civil Engineers; Martin Powell, Chief Sustainability Officer of Siemens USA; Jim Hoecker, Senior Counsel & Energy Strategist, Husch Blackwell and Former Chairman of the Federal Energy Regulatory Commission (FERC); Steven Landau, economist and Executive Vice-President at EBP-US; and Otto Lynch, President, and CEO of Power Line Systems, Member of ASCE’s Committee on America’s Infrastructure.

The energy sector has transformed since 2011, the last time ASCE conducted this report. Today, the U.S. energy grid is transitioning from a fossil-fueled central generation model to a more diversified and decentralized generation portfolio. In 2019, total renewable generation exceeded coal-fueled generation for the first time, a trend that is expected to continue. Electric vehicles (EV) are continuing to penetrate the market: EV charging stations within the United States have grown from 6,900 workplaces, public and DC fast chargers in 2012 to approximately 61,000 by the end of 2017 for all vehicles. With coal plants rapidly retiring and being replaced mainly by combined-cycle natural-gas fuel units, wind and solar energy are increasingly contributing to the overall generation mix. Resilience concerns are also driving infrastructure investment in the sector. The weather has always been the number one reliability threat, but climate change has accelerated the number and intensity of disasters and associated costs. These transitions require significant updates to our existing energy infrastructure and transmission and distribution systems must accommodate this shift by making significant investments in the electricity grid, which protects the economy, public safety, and the environment.

There were, however, some positive trends. Over the last 10 years, there has been a significant uptick in investments in transmission systems as transmission investments increased from $15.6 billion in 2012 to an average actual and planned annual average of $21.0 billion from 2013 through 2021. Edison Electric Institute’s (EEI) survey of its member investor-owned utilities and stand-alone transmission companies found that the surge in investment was related to providing access to clean energy and increasing the grid’s reliability, security, and resiliency. Spending also reduced congestion, eased resource pricing, and helped to better meet current and future customer needs. Recent investment appears to be sufficient to serve the existing system.

Yet, the U.S. is facing a $338 billion shortfall by 2039 in what is needed to ensure a reliable energy system. If adequate investments to replace and upgrade our nation’s electric generation, transmission, and distribution systems do not occur, costs—in the form of higher costs for electric power, costs incurred because of power unreliability, or costs associated with adopting more expensive industrial processes—will be borne by both households and businesses.

Interruptions in the form of power outages have also continued. Among 638 events reported from 2014-2018, severe weather was cited as the cause of 50% of outages, systems operations were responsible for 18 %of outages, and transmission disruptions/interruption, or unexpected failures in transmission, were cited as the cause of 32% of primary outage event causes. In 2019, a much higher percentage of transmission outages – 46%– were attributed to transmission disruption/interruption.

Today, businesses and industry sectors are becoming more interconnected, increasingly relying upon data centers to perform day-to-day functions and plan for the future. Momentary fluctuations such as voltage drops or surges impact the industries in various ways, and the cost of a data center outage has increased in recent years. In 2016, the average cost of a data center outage was $8,851 per minute, compared to $5,617 in 2010. The average length of disruption was 95 minutes— only slightly down from the 97 minutes in 2010. While the duration of these outages has decreased, the average cost of data center outages has increased from $505,000 in 2010 to $750,000 in 2016. Rising incidences of voltage surges, and blackouts, and brownouts that disrupt production will add costs to businesses that will make U.S. manufactured products less competitive in international markets.

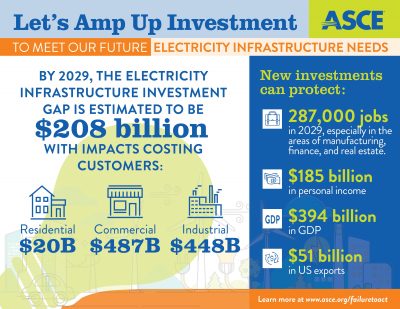

This analysis finds that unless investment in generation, transmission, and distribution increases, the following notable economic outcomes are expected:

- Almost $637 billion in cumulative business sales (gross output) will be lost from 2020 to 2029.

- By 2039, the total output lost will be nearly $3 trillion, as demand for electricity rises amid industries’ continued navigation of brownouts and voltage surges.

- Our cumulative GDP will fall by $394 billion by 2029 and by more than $1.7 trillion by 2039. Reductions to GDP reflect lost income for workers and business owners.

- By 2029, 287,000 jobs are projected to be lost; by 2039 the total will rise to 540,000.

The full report may be found at asce.org/electricity.org.